Double Eagle DeFi "LEGO" Lending Cryptocurrency

Double Eagle has made a key layout in four sectors: asset security, platform governance, system risk control and community construction.

LONDON, UNITED KINGDOM, June 18, 2021 /EINPresswire.com/ -- In the field of DeFi, "decentralized lending" acts as the hub between the various roles, connecting the fields of DEX (decentralized exchange), stable currency, lending and so on.

The expansion of DeFi is still driving the emergence of a large number of new assets, and leading to changes in users' borrowing needs with the development of the industry. In addition to mature lending platforms such as maker and compound, a number of DeFi lending platforms such as AAVE, Double Eagle and Venus are also entering the market through improvement and innovation to jointly improve the new financial lending system in the cryptocurrency market.

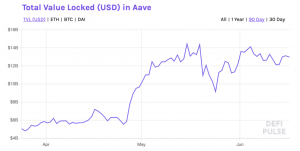

AAVE launched V2 in August 2020 to innovate in fixed rate deposit, stable loan interest rate, credit entrustment, collateral change, batch flash loan, debt token, community governance, etc. Through these innovations, AAVE's TVL directly exceeded US $1 billion, an increase of more than 79%.

Through the expansion and extension of functions, the platform has effectively improved its TVL and market expectations: AAVE's TVL has reached US $3329 million in less than one year.

Double Eagle will go online in July to carry out asset pooling from the perspectives of smart contract and market risk, so as to improve the utilization rate of funds. Double Eagle has made a key layout in four sectors: asset security, platform governance, system risk control and community construction.

Users can release the liquidity of dtoken in line with the risk control rules through Double Eagle according to the high-quality lending assets of the platform, so as to help users obtain higher comprehensive income.

(source: debank)

The above is the main process of the DeFi lending market shown by debank. At present, the total amount of loans in the DeFi lending market has reached 17.4 billion US dollars, with huge development space.

It can be seen that in the DeFi lending platform, all are eager to become the next "AAVE".

Innovation of DeFi mainstream lending platform

In most of the product renewal ideas, "income farming", "flash loan", "Dao governance" and other innovative models have been generally accepted by the market.

Compound was the first company to mine liquidity. Since then, AAVE has grown rapidly through flash loans, multi token support and non mortgage loans. In mid-2020, after curve launched mobile mining and year launched revenue farming, both of them used AAVE pool, which raised the TVL of AAVE to a high level of several months, almost equal to maker.

(data source: defipulse)

As a DeFi lending platform, Double Eagle is of the same type as compound and AAVE platforms: over mortgage of encrypted assets, lending other types of encrypted assets, including stable currency and cryptocurrency.

At present, the market is still dominated by fund pool lending, and the volume of bond platform business is limited. V3 solves the current single fund pool problem in DeFi lending, token economic model and platform governance issues, security issues, and community construction issues. This is also something that every lending product needs to consider.

Double Eagle will provide users with a more flexible way to manage their money, and become the engine of DeFi. It will release the power of blockchain, change production relations and productivity, and finally achieve common governance.

Dao governance model is introduced into Double Eagle community to balance the profit distribution, risk-taking and governance decision-making of Double Eagle. Through this model, DOE users can connect their personal interests with the platform, aiming to improve token holders' willingness and participation in platform governance.

Where compound and AAVE set up a "base" through "DeFi LEGO", the lending platform they entered later needs to explore new paths.

Double Eagle takes another approach, putting the breakthrough point on the BSC track. At present, there are few and imperfect loan projects on coin on smart chain (BSC). Double Eagle is one of the loan projects deployed on BSC, which avoids the fierce competition of Ethereum to a certain extent. By capturing the value of the token on BSC and the exchange of coin security ecosystem, there is a certain potential for the development of new markets.

Users can deposit mainstream tokens in Double Eagle, including a large number of currencies (such as bnb-busd) in the coin security ecosystem, so as to obtain additional Double Eagle credit lines while making profits, so as to improve the utilization rate of funds.

Double Eagle not only guarantees the original expected income of users, but also provides additional flexible credit lines to release the liquidity of some locked assets, so as to improve the utilization rate of funds. In this way, users can implement other profit strategies, such as trading with leverage and other financial derivatives.

In addition, users can still get the expected apy mining reward after storing dtoken in Double Eagle.

Coin safety intelligent chain (BSC) is one of the important development directions of coin safety. As one of the projects based on BSC, Double Eagle has its own advantages and can obtain more resources. Double Eagle and BSC may have more opportunities to cooperate with each other and bring more benefits to users. With the establishment of more and more BSC ecological projects, more and more mine pools will be launched on the platform, which will attract more BSC users to use Double Eagle.

In the development and innovation of the DeFi lending platform, the financial lending system of the whole industry has been meeting the needs of more new transactions.

Reviewing the development path of DeFi lending, this field has achieved great success. The scale of decentralized lending continues to expand. In the past year, the total amount has increased nearly 100 times. It forms the development trend by encrypting the unique "LEGO" of the community. The concept of open finance is also trying to build a new field parallel to the traditional financial industry, and it is also constantly combining with the traditional finance.

Double Eagle Community

Telegram:https://t.me/DoubleEagleFinance

Twitter:https://twitter.com/Double__Eagle

Facebook:https://www.facebook.com/Doubleeaglefinance

Facebook group: https://www.facebook.com/groups/doubleeagle

Medium:https://medium.com/double-eagle-finance

Double Eagle

Double Eagle

admin@doubleeagle.io

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.