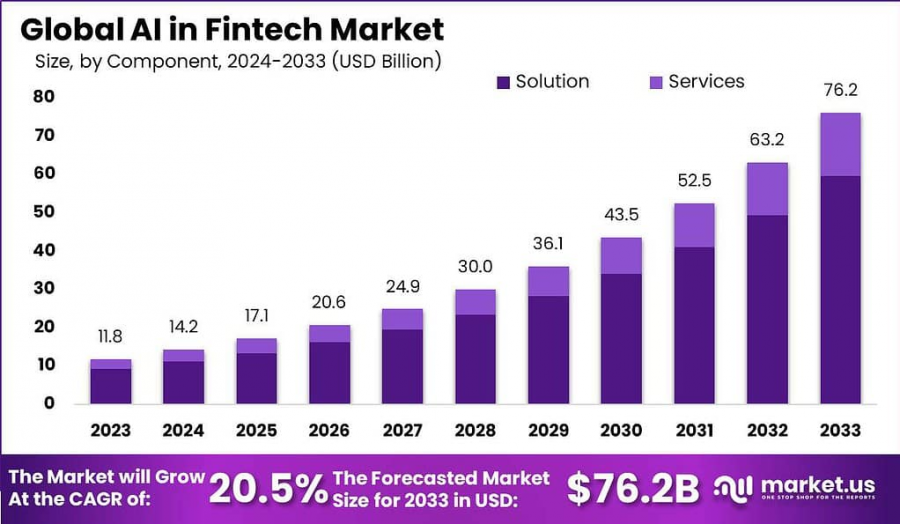

AI In Fintech Market Growing at a CAGR of 20.5% During the Forecast Expected to be Worth Around USD 76.2 Billion by 2033

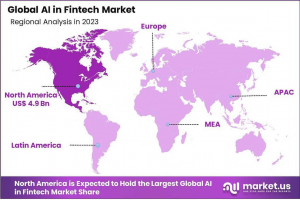

In 2023, North America led the AI in the Fintech market with a 41.5% share, valued at USD 4.9 billion, and is expected to grow significantly...

NEW YORK, NY, UNITED STATES, January 24, 2025 /EINPresswire.com/ -- The global AI in the Fintech market is experiencing rapid growth, with the market size expected to reach USD 76.2 billion by 2033, up from USD 11.8 billion in 2023, reflecting a robust compound annual growth rate (CAGR) of 20.5% from 2024 to 2033. This growth is driven by several factors, including the increasing demand for automation, enhanced security, and real-time data analytics in financial services.

Key drivers include the growing adoption of AI technologies in fraud detection, credit scoring, and risk management, as well as the increasing use of chatbots and robo-advisors for customer service and financial planning. AI enables financial institutions to make data-driven decisions quickly, improving operational efficiency and reducing costs. Additionally, the rising use of blockchain and AI for secure, transparent transactions is also pushing the market forward.

🔺 Click Here To Get a PDF Research Sample (no cost) @ https://market.us/report/ai-in-fintech-market/request-sample/

Technological advancements in machine learning, deep learning, and natural language processing are further enhancing the capabilities of AI in fintech, allowing for more personalized and accurate financial services. As fintech companies and traditional banks continue to embrace AI, market demand for innovative solutions is expected to rise. The regulatory environment and government incentives also play a crucial role in fostering AI adoption, driving investments, and ensuring secure, compliant applications.

Key Takeaways:

-- The AI in the Fintech market is set to experience significant growth, with an estimated value of USD 76.2 billion by 2033.

-- Investments in AI-driven fintech companies surpassed $10 billion in 2023, reflecting strong market confidence and support for AI technologies.

-- In 2023, the Solution segment dominated the AI in the Fintech market, holding a substantial share of over 78.3%.

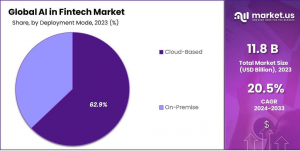

-- The Cloud segment continued to show strong growth in 2023, driven by the increasing adoption of cloud-based AI solutions in financial services.

Key Statistics:

92% of financial services firms are currently investing in AI and machine learning technologies, according to a 2022 Finastra survey. This highlights a strong commitment to AI adoption in the sector.

Top use cases for AI in financial services, as identified in the survey, include:

Risk analytics: Helping firms assess and mitigate financial risks with more accuracy.

Predictive modeling: Enabling businesses to forecast trends and customer behaviors.

Trade optimization: Improving trading strategies and decision-making processes.

The growing integration of AI in the financial sector is set to enhance operational efficiencies, improve customer experiences, and foster innovations in fraud detection, compliance, and risk management.

🔺 Get the Full Report at Exclusive Discount (Limited Period Only) @ https://market.us/purchase-report/?report_id=115628

Experts Review on AI in the Fintech Market

The AI in the Fintech market is rapidly growing, fueled by technological innovations and increasing government incentives. Governments across the globe are investing heavily in AI research and providing tax incentives and funding programs to encourage AI adoption in the financial sector. This is especially prominent in regions like North America and Europe, where AI integration is transforming operations, enhancing security, and optimizing customer experiences.

Technological advancements such as machine learning, natural language processing, and blockchain are driving innovation in fintech, enabling enhanced predictive modeling, fraud detection, and automated customer service. These innovations are creating substantial investment opportunities, with venture capital and private equity pouring billions into AI-focused fintech startups. However, these investments come with risks related to data privacy concerns, regulatory compliance, and the challenge of staying ahead of rapidly evolving technologies.

As consumer awareness of AI grows, there is increasing demand for transparent, secure, and user-friendly AI-driven financial services. Financial institutions must adapt by educating their customers about AI’s benefits while addressing concerns around data protection.

The regulatory environment remains a key challenge, as governments work to create frameworks that ensure the safe and ethical use of AI in fintech. Striking the right balance between innovation and regulation will be crucial for the sustained growth of AI in the financial services sector.

Report Segmentation

Technology: The market is primarily divided into Machine Learning (ML), Natural Language Processing (NLP), and Robotic Process Automation (RPA). Machine Learning holds the largest share, driving predictive analytics and risk management solutions. NLP is gaining traction due to its use in enhancing customer service through chatbots and sentiment analysis. RPA is increasingly adopted for automating repetitive tasks and improving operational efficiency.

Application: Key applications include Fraud Detection & Prevention, Credit Scoring & Underwriting, Customer Service, and Risk Management. Fraud detection is one of the fastest-growing segments, as AI is used to analyze transaction patterns and identify anomalies in real-time. Credit scoring benefits from AI's ability to analyze vast amounts of financial data to assess creditworthiness more accurately.

Deployment Model: The market is also categorized by On-premises and Cloud-based solutions. Cloud-based AI solutions are growing in popularity due to their scalability, lower upfront costs, and ease of integration.

Region: The market is analyzed across regions such as North America, Europe, Asia-Pacific, and the Rest of the World. North America holds the largest market share, driven by strong investments in AI and fintech infrastructure.

🔺 Get a PDF Research Sample (no cost) @ https://market.us/report/ai-in-fintech-market/request-sample/

Key Market Segments

Component

-- Solution

-- Services

Deployment Mode

-- Cloud-Based

-- On-Premise

Application

-- Fraud Detection

-- Analytics & Reporting

-- Customer Service & Engagement

-- Risk Assessment

-- Customer Behavioural Analytics

-- Other Applications

Drivers:

The AI in the Fintech market is propelled by several key factors. The growing demand for automation and enhanced customer experience in financial services is a major driver, with AI enabling faster decision-making, fraud detection, and personalized offerings. The increasing volume of financial data and the need for real-time analytics further fuel AI adoption. Additionally, AI technologies like machine learning, natural language processing, and robotics are being integrated into applications such as risk management, credit scoring, and customer service, boosting market growth.

Restraints:

Despite its growth, there are challenges to AI adoption in fintech. Data privacy and security concerns remain significant barriers, as sensitive financial information is at risk. High implementation costs and the need for skilled professionals to develop and manage AI systems can also hinder adoption, particularly for smaller financial institutions.

Challenges:

AI in fintech faces challenges related to regulatory compliance, as existing financial regulations may not fully address AI-driven systems. Additionally, integrating AI with legacy systems can be complex and time-consuming, creating operational challenges for financial firms.

Opportunities:

AI in the fintech market presents immense opportunities, especially in areas like fraud detection, robo-advisory services, and credit risk analysis. The growing focus on AI-powered customer personalization and automated solutions provides opportunities for innovation. Additionally, advancements in AI technologies are lowering the barrier for smaller fintech companies, enabling wider adoption and competition in the market.

🔺 Hurry Exclusive Discount For Limited Period Only @ https://market.us/purchase-report/?report_id=115628

Key Player Analysis

IBM – A leader in AI and blockchain solutions, IBM offers AI-powered services for fintech applications such as fraud detection, risk management, and customer insights. Their AI platform, IBM Watson, provides advanced analytics and natural language processing (NLP) to enhance decision-making.

Google Cloud – Google’s AI and machine learning solutions are widely used in the fintech industry, offering tools like Google AI and AutoML to automate tasks, analyze large data sets, and improve customer experience. Google Cloud’s data infrastructure supports financial institutions in adopting AI.

Microsoft – Microsoft provides a suite of AI tools and cloud services, such as Azure AI, tailored for fintech applications. These tools are focused on risk analytics, fraud prevention, and personalized customer service, helping financial institutions leverage AI for better decision-making.

Nvidia – Known for its high-performance computing hardware, Nvidia powers AI-driven fintech applications with GPUs designed for processing complex algorithms in real time. Nvidia's solutions are crucial in supporting AI adoption for predictive analytics, algorithmic trading, and risk assessment.

Top Market Leaders

IBM Corporation

Microsoft Corporation

Google LLC

Amazon Web Services, Inc.

Nuance Communications, Inc.

Axyon AI

ForwardLane

Salesforce, Inc.

SAS Institute Inc.

Mastercard Inc

Inbenta Technologies Inc.

Amelia.ai

Other Key Players

Recent Developments

AI-Powered Fraud Detection: Companies like Mastercard and Visa have integrated AI-based fraud detection systems that analyze transactional data in real-time to detect and prevent fraudulent activities, ensuring enhanced security for financial transactions.

Personalized Financial Services: JPMorgan Chase and Bank of America are leveraging AI to deliver personalized financial advice and services. Using machine learning algorithms, these institutions offer tailored recommendations, improving customer experience and retention.

Blockchain and AI Integration: IBM has expanded its blockchain solutions by integrating AI to streamline financial transactions, enhance transparency, and reduce operational costs.

Regulatory Technology (RegTech): FinTech startups are increasingly adopting AI for regulatory compliance. Solutions focused on automating compliance monitoring, anti-money laundering (AML), and Know Your Customer (KYC) protocols are gaining traction in the industry.

Conclusion

The AI in the Fintech market is rapidly expanding, driven by advancements in machine learning, automation, and data analytics. As financial institutions increasingly adopt AI to enhance efficiency, security, and customer experience, the market is expected to grow significantly in the coming years.

Key factors such as government incentives, technological innovations, and rising consumer demand for personalized services will continue to fuel this growth. While challenges like data privacy concerns and regulatory hurdles remain, the opportunities for innovation, particularly in fraud detection, risk management, and customer service, are immense, positioning AI as a transformative force in fintech.

Aircraft Engine Market - https://market.us/report/aircraft-engine-market/

Electronic Shift Operations Management Solutions (eSOMS) Market - https://market.us/report/electronic-shift-operations-management-solutions-esoms-market/

Human Capital Management Market - https://market.us/report/human-capital-management-market/

AI in Data Quality Market - https://market.us/report/ai-in-data-quality-market/

AI in Teaching Market - https://market.us/report/ai-in-teaching-market/

AI In ERP Market - https://market.us/report/ai-in-erp-market/

Operational Technology (OT) Security Market - https://market.us/report/operational-technology-ot-security-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release