Procurement Intelligence Report Crude Oil Market Pricing and Vendor Analysis

The pricing outlook for crude oil is expected to exhibit moderate volatility, influenced by various critical factors.

NEW YORK, NY, UNITED STATES, January 16, 2025 /EINPresswire.com/ -- Procurement Intelligence for the Crude Oil Market Overview

The Procurement intelligence Crude Oil Market is a dynamic sector, with its price, demand, and supply heavily influenced by geopolitical, economic, and environmental factors. In recent years, procurement intelligence has become an essential tool for businesses in the oil and gas industry, enabling them to make informed purchasing decisions, optimize supply chain strategies, and gain a competitive edge.

Procurement intelligence in crude oil refers to the data-driven insights and strategies used to understand and leverage market trends, supplier performance, and procurement processes. This article provides an in-depth overview of the crude oil market, examining its segmentation, market trends, drivers, restraints, and future outlook.

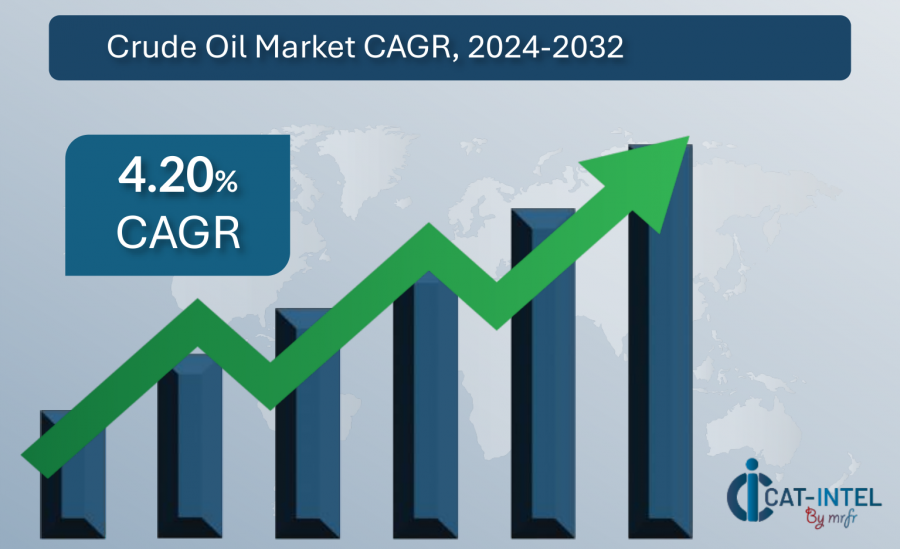

Market Size: The crude oil market is projected to reach USD 10.57 billion by 2032, growing at a CAGR of approximately 4.20 % from 2024 to 2032.

Crude oil is a vital energy resource and is often referred to as the lifeblood of the global economy. It is a naturally occurring fossil fuel used to produce petroleum products such as gasoline, diesel, jet fuel, and petrochemicals. The global crude oil market is dominated by a handful of major players, including the Organization of the Petroleum Exporting Countries (OPEC), Russia, and the United States. Global demand for crude oil is influenced by various factors, including industrial activity, transportation needs, energy generation, and geopolitical tensions.

Request a Free Sample Copy or View Report Summary: https://www.marketresearchfuture.com/cat-intel/sample_request/158

Procurement Intelligence for the Crude Oil Market Segmentations

The crude oil market is segmented based on various factors such as geographical regions, production types, and end-use industries. Understanding these segments helps stakeholders navigate the complexities of the market and make informed decisions.

Geographic Segmentation:

North America: Home to major oil-producing countries such as the United States and Canada, North America is a significant player in the global crude oil market. The shale oil revolution in the U.S. has had a substantial impact on global supply and pricing dynamics.

Middle East: The Middle East remains the world's largest crude oil producer, with countries like Saudi Arabia, Iraq, and Iran controlling a major share of global reserves.

Europe and Russia: Europe, while not a top producer, is a crucial player in the consumption of crude oil, with Russia acting as a significant exporter to the region.

Asia-Pacific: The Asia-Pacific region, including China and India, represents the largest growth market for crude oil consumption. The demand for energy and transportation fuels in these emerging economies drives crude oil procurement trends.

Production Type Segmentation:

Conventional Crude Oil: Extracted from traditional oil wells, conventional crude oil still dominates global production. However, its reserves are depleting, prompting more exploration in non-conventional sources.

Unconventional Crude Oil: This includes oil sands, shale oil, and tight oil, primarily sourced from North America. Unconventional production techniques, such as hydraulic fracturing, have increased supply but come with higher costs and environmental concerns.

Offshore Crude Oil: Extracted from beneath the ocean floor, offshore crude oil is typically more expensive to produce due to the complex drilling and production methods involved.

End-Use Segmentation:

Transportation: The transportation sector, including cars, airplanes, and ships, is the largest consumer of crude oil, with gasoline and diesel being the most widely used refined products.

Industrial: Industries such as petrochemicals, manufacturing, and construction rely heavily on crude oil derivatives, including lubricants and bitumen.

Power Generation: Some regions still rely on crude oil for electricity generation, particularly in areas lacking natural gas infrastructure.

Market Trends Highlights

Several key trends are currently shaping the global crude oil market, particularly in the context of procurement intelligence:

Price Volatility and the Role of OPEC: Crude oil prices are notoriously volatile, influenced by geopolitical events, changes in demand, and production decisions made by major suppliers like OPEC. Procurement professionals must navigate this uncertainty, adjusting their sourcing strategies to minimize risks. By closely monitoring OPEC’s output decisions and inventory reports, businesses can better predict price movements and secure more favorable procurement contracts.

Technological Advancements in Exploration and Production: The oil industry has seen significant advancements in drilling and extraction technologies, particularly in unconventional oil production. Technologies like hydraulic fracturing and horizontal drilling have led to increased production from shale formations, especially in North America. This has influenced procurement strategies, making it easier to identify cost-efficient suppliers with access to new sources of crude oil.

Shifting Demand from Emerging Markets: Countries in the Asia-Pacific region, especially China and India, are experiencing rapid economic growth, resulting in increased demand for energy and crude oil. Procurement managers in the energy sector are adjusting their strategies to secure long-term supply contracts with suppliers that can meet the rising demand from these emerging markets.

Sustainability and the Shift to Renewable Energy: The growing emphasis on sustainability and the shift towards renewable energy sources are also influencing the crude oil market. As countries adopt stricter environmental regulations, procurement intelligence is helping businesses identify suppliers who are adhering to sustainability practices, thus reducing exposure to risks associated with non-compliance.

Market Drivers

The key drivers of the crude oil market include:

Global Economic Growth: As global economies expand, industrial activities and transportation needs increase, driving up demand for crude oil and its derivatives. Particularly in emerging markets, economic growth spurs higher energy consumption.

Geopolitical Tensions and Supply Disruptions: Political instability in oil-producing regions often leads to supply disruptions, which can cause price spikes. Procurement managers must stay alert to geopolitical developments to protect their organizations from supply chain disruptions.

Technological Innovations: Technological advancements in oil extraction and refining processes continue to improve production efficiency and reduce costs, making crude oil more accessible and affordable.

For detail insights on this market, request for methodology here: https://www.marketresearchfuture.com/cat-intel/procurement-intelligence-crude-oil-market

Market Restraints

Despite the growth potential of the crude oil market, several challenges exist:

Environmental Regulations: Stricter environmental regulations, particularly related to carbon emissions and drilling practices, impose additional costs on producers and influence procurement strategies.

Price Fluctuations: The crude oil market remains highly susceptible to price fluctuations, driven by both demand and supply-side factors. This volatility can create uncertainty for procurement professionals who need to balance costs and supply stability.

Shifting Energy Preferences: Increasing investments in renewable energy sources, such as wind and solar power, could reduce global dependence on crude oil in the long term. This shift may dampen long-term growth prospects for the crude oil market.

Future Outlook

The outlook for the crude oil market is uncertain, with various factors influencing its trajectory. While the demand for crude oil will continue to grow in the short term, particularly in emerging economies, the long-term trend could shift as renewable energy technologies become more cost competitive. The market will likely see increased investment in sustainable oil extraction practices, and the rise of electric vehicles could reduce demand for transportation fuels. Additionally, procurement intelligence will remain crucial for businesses to navigate the complexities of this dynamic market, enabling them to make strategic decisions and secure optimal supply contracts.

More Procurement Intelligence-Related Reports:

Category Intelligence Directional Drilling Services Market: https://www.marketresearchfuture.com/cat-intel/procurement-intelligence-directional-drilling-services-market

Category Intelligence for Diesel Market: https://www.marketresearchfuture.com/cat-intel/procurement-intelligence-for-diesel-market

Category Intelligence for China's Electricity Market: https://www.marketresearchfuture.com/cat-intel/procurement-intelligence-china-electricity-market

Category Intelligence for Coal Market: https://www.marketresearchfuture.com/cat-intel/procurement-intelligence-coal-market

Market Research Future

Market Research Future

+ + 1 855-661-4441

email us here

Distribution channels: Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release