Parametric Insurance Market to hit USD 40 Bn by 2033, North America 35% share, holding USD 5.5 Bn revenue.

Parametric Insurance Market Size

The Global Parametric Insurance Market is projected to grow from USD 17 bn in 2024 to USD 40.6 bn by 2033, with a healthy 9.9% CAGR (2024-2033).

NEW YORK, NY, UNITED STATES, January 24, 2025 /EINPresswire.com/ -- According to the research conducted by Market.us, Parametric insurance, also known as index-based insurance, is a type of coverage where payouts are triggered by predefined parameters, such as weather conditions, natural disasters, or other quantifiable events, rather than actual loss assessments. This innovative model offers quicker claims processing and greater transparency, addressing the inefficiencies of traditional insurance.

The growth of the parametric insurance market is primarily driven by increasing climate-related risks, such as hurricanes, floods, and wildfires, which are becoming more frequent and severe. Businesses and governments are seeking innovative ways to mitigate financial losses associated with such disasters. Additionally, the growing awareness of risk management in sectors like agriculture, energy, and construction has further propelled the demand for parametric insurance solutions.

The adoption of artificial intelligence (AI) is significantly shaping market trends. AI-powered models improve risk assessment and pricing accuracy by analysing vast amounts of historical and real-time data, such as satellite imagery, weather forecasts, and IoT device inputs. AI also enhances customer experience by enabling seamless underwriting and faster claims settlements, making parametric insurance an attractive choice.

👉 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/report/parametric-insurance-market/request-sample/

Demand for parametric insurance is surging across industries due to its ability to provide swift financial relief and fill gaps left by traditional insurance policies. Technological advancements, such as blockchain for smart contracts and advanced data analytics, are further revolutionizing the market. These technologies enhance transparency, trust, and efficiency in policy administration, driving broader adoption.

Key Takeaways

In 2023, the Natural Catastrophes Insurance segment held a dominant market position within the parametric insurance market, capturing more than a 48% share.

In 2023, the Agriculture segment held a dominant market position within the parametric insurance market, capturing more than a 27% share.

In 2023, the Direct Sales segment held a dominant market position within the parametric insurance market, capturing more than a 40% share.

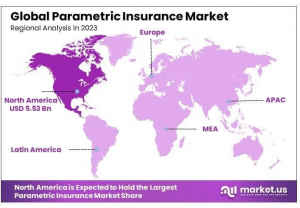

North America leads the Parametric Insurance market with a 35% share, valued at USD 5.53 billion in 2023.

👉 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=129704

Analyst’s Viewpoint

The parametric insurance market is witnessing significant growth, driven by increasing climate-related risks and a growing need for innovative risk mitigation strategies. Analysts highlight that the market offers substantial investment opportunities, particularly in sectors such as agriculture, energy, construction, and tourism, where businesses face substantial exposure to natural disasters and unpredictable weather patterns.

Government incentives and policy frameworks aimed at improving disaster preparedness and resilience are creating a conducive environment for market expansion. Many governments are actively promoting parametric insurance through subsidies and public-private partnerships, especially in regions vulnerable to natural catastrophes, such as Asia-Pacific and Latin America. Technological advancements, including AI-powered risk modeling, blockchain-based smart contracts, and satellite imagery for data collection, are further driving the market by enhancing efficiency, accuracy, and transparency.

However, the market also faces challenges, including regulatory complexities, limited consumer awareness, and the difficulty of designing accurate and comprehensive parametric triggers. Companies investing in consumer education campaigns and collaborative partnerships with governments and regulatory bodies are well-positioned to mitigate these risks. Analysts emphasize the importance of addressing these challenges while leveraging technological innovations to unlock the market's full potential.

Report segmentation

Type Analysis

In 2023, the Natural Catastrophes Insurance segment held a dominant market position within the parametric insurance market, capturing more than a 48% share. This segment's prominence is driven by the increasing frequency and severity of natural disasters, such as hurricanes, floods, and earthquakes, coupled with the urgent need for faster, more transparent financial relief mechanisms.

Governments and organizations in disaster-prone regions are actively adopting parametric solutions to mitigate economic losses, further fuelling growth in this segment. Advanced technologies such as satellite imaging and AI-powered predictive models are enabling more precise risk assessments, enhancing the appeal of parametric insurance for natural catastrophes.

The Specialty Insurance segment, meanwhile, is emerging as a significant growth area, catering to niche markets such as event cancellations, crop insurance, and renewable energy projects. With businesses and industries increasingly seeking customized risk management solutions, this segment is gaining traction, supported by innovations like IoT devices and real-time data monitoring for specific risk triggers.

Application Analysis

In 2023, the Agriculture segment held a dominant market position within the parametric insurance market, capturing more than a 27% share. This dominance is attributed to the sector's high vulnerability to climate-related risks, such as droughts, floods, and extreme weather events, which have significantly impacted crop yields globally. Farmers and agribusinesses are increasingly turning to parametric insurance solutions to ensure timely financial relief and minimize operational disruptions.

Government initiatives and subsidies, particularly in emerging economies with agriculture-driven GDPs, are further boosting the adoption of parametric insurance in this sector. Advanced technologies, including satellite data and IoT sensors, are enabling precise risk assessments tailored to agricultural needs, reinforcing the segment's growth.

The Energy & Utilities segment is another key contributor, driven by the rising adoption of renewable energy sources like wind and solar, which are highly dependent on weather conditions. Parametric insurance offers tailored solutions to address risks such as insufficient wind or solar irradiation, ensuring financial stability for energy producers.

The Real Estate and Construction segments are also gaining momentum as stakeholders seek innovative ways to mitigate risks from natural disasters and project delays. Similarly, the Marine and Travel & Tourism segments are witnessing growth due to increasing awareness of parametric solutions for mitigating weather-related disruptions.

Distribution Channel Analysis

In 2023, the Direct Sales segment held a dominant market position within the parametric insurance market, capturing more than a 40% share. This dominance is driven by the ability of insurers to establish direct relationships with clients, offering tailored solutions and personalized services. Businesses and large organizations, particularly in sectors such as agriculture, energy, and construction, prefer direct engagement with insurers to ensure customized policies that align with their specific risk profiles. Additionally, the streamlined communication and faster policy execution provided by direct sales channels are key factors contributing to this segment's growth.

The Brokers segment, while slightly less dominant, plays a crucial role in the market, particularly for small and medium-sized enterprises (SMEs) and clients seeking expertise in navigating complex parametric insurance products. Brokers act as intermediaries, leveraging their market knowledge to provide clients with the most suitable coverage options. This segment is expected to grow steadily, supported by increasing demand for specialized risk management services across various industries.

The Online Platforms segment, though currently holding a smaller market share, is witnessing rapid growth due to the rising digitization of insurance processes. Online platforms appeal to tech-savvy consumers and businesses by offering convenience, transparency, and cost-effectiveness. With advancements in AI-powered tools and digital interfaces, this segment is anticipated to expand further, especially among younger and digitally native customers who prioritize seamless, self-service insurance solutions.

👉 𝐂𝐥𝐢𝐜𝐤 𝐭𝐨 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞 𝐈𝐦𝐩𝐚𝐜𝐭𝐟𝐮𝐥 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬: https://market.us/report/parametric-insurance-market/free-sample/

Regional Analysis

North America leads the Parametric Insurance market with a 35% share, valued at USD 5.53 billion in 2023. The region's dominance is driven by a robust insurance industry, widespread adoption of advanced risk management solutions, and increasing awareness of climate-related risks. Sectors such as agriculture, energy, and construction are adopting parametric insurance to mitigate losses from natural disasters, including hurricanes and wildfires.

Additionally, regulatory frameworks and favorable government policies supporting innovative insurance models have further accelerated market growth in North America. The presence of major insurance providers and technology firms offering parametric solutions solidifies the region’s leadership in this market.

The Asia-Pacific (APAC) region is experiencing rapid expansion in the parametric insurance market, primarily due to growing vulnerabilities to climate change, including typhoons, floods, and droughts. Countries like China, India, and Japan are emerging as key markets, driven by government programs to promote disaster risk financing and an expanding agriculture sector adopting innovative insurance models. The rise of insurtech start-up in APAC further contributes to the adoption of parametric insurance solutions.

Key Player Analysis

One of the leading player in the market is Berkshire Hathaway Inc. which has been actively involved in offering innovative parametric insurance solutions tailored to address complex and high-severity risks. Its parametric policies are particularly focused on weather-related events, such as hurricanes, earthquakes, and other natural catastrophes. The company leverages its deep financial capacity and expertise to design bespoke policies for industries like agriculture, real estate, and energy.

Another prominent firm is Chubb Limited, a global leader in parametric insurance solutions, offering a diverse portfolio designed to meet the unique needs of businesses and governments. The company focuses on providing rapid financial protection against natural disasters and weather-related risks, with a strong emphasis on innovation and customer-centric solutions.

Top Key Players in the Market

Allianz Group

AXA SA

Zurich Insurance Group Ltd.

Berkshire Hathaway Inc.

Chubb Limited

Munich Re Group

FloodFlash Limited

Neptune Flood Incorporated

Global Parametrics Limited

Swiss Re

Other Key Players

👉 𝐃𝐫𝐢𝐯𝐞 𝐘𝐨𝐮𝐫 𝐆𝐫𝐨𝐰𝐭𝐡 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲! 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐔𝐧𝐜𝐨𝐯𝐞𝐫 𝐊𝐞𝐲 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: https://market.us/purchase-report/?report_id=129704

Emerging Trends

Artificial intelligence (AI) and big data analytics are transforming the parametric insurance landscape. Insurers are leveraging these technologies to enhance risk modeling, assess potential triggers, and predict future events with greater accuracy. Real-time data from sources like IoT devices, satellite imagery, and weather sensors is enabling more precise underwriting and faster claims processing.

While traditional segments like agriculture and energy remain dominant, parametric insurance is gaining traction in niche areas, including travel disruptions, event cancellations, and pandemic-related risks. This diversification is opening new markets and catering to a broader range of industries and customer needs.

Blockchain technology is being increasingly adopted to enable smart contracts and improve transparency and efficiency in the claims process. These contracts automatically execute payouts when predefined conditions are met, reducing disputes and enhancing trust between insurers and policyholders.

Top Use Cases

Agriculture Risk Management: Parametric insurance is widely used in agriculture to address weather-related risks such as droughts, floods, and storms. Farmers and agribusinesses can secure financial relief based on triggers like rainfall levels or temperature thresholds, enabling them to recover quickly from crop losses. For example, in drought-prone regions in Africa, parametric policies are helping smallholder farmers stabilize their incomes and ensure food security.

Natural Catastrophe Coverage: This insurance is commonly utilized to mitigate the financial impact of natural disasters like hurricanes, earthquakes, and floods. For instance, Caribbean nations have implemented parametric insurance programs to manage recovery costs after hurricanes, using predefined wind speed or earthquake magnitude as payout triggers.

Renewable Energy Risk Mitigation: Parametric insurance is increasingly used in the renewable energy sector to manage risks associated with insufficient wind or solar irradiation. Policies are triggered when energy production falls below specific thresholds, helping operators maintain financial stability and investor confidence.

Major Challenges

One of the most significant challenges is basis risk, which arises when the predefined parameters used to trigger payouts do not perfectly align with the actual losses incurred by the policyholder. For example, a farmer might experience crop damage due to a localized drought, but if the parameter (e.g., regional rainfall index) does not meet the threshold, no payout would be triggered. This misalignment can reduce trust in parametric insurance solutions.

Designing accurate and comprehensive triggers that reflect real-world risks is a complex task. It requires extensive data analysis, advanced modeling, and expert input, which can be time-consuming and costly. Moreover, the lack of sufficient historical data in certain regions or industries further complicates this process.

The regulatory environment for parametric insurance is still evolving in many markets. Ambiguities regarding the classification of parametric products, compliance requirements, and cross-border policies create hurdles for insurers looking to expand their offerings. These regulatory complexities can delay product launches and restrict market growth.

Attractive Opportunities

The parametric insurance market is presenting numerous lucrative opportunities, driven by the growing demand for innovative, transparent, and efficient risk management solutions. One of the most attractive opportunities lies in climate risk mitigation, as the frequency and severity of natural disasters continue to rise globally.

Governments, corporations, and individuals in disaster-prone regions are seeking faster payouts to manage recovery efforts, positioning parametric insurance as a critical tool for resilience. The increasing adoption of such solutions in developing economies, particularly in Asia-Pacific, Latin America, and Africa, offers a vast untapped market for insurers.

The agriculture sector represents another significant opportunity due to its high exposure to weather-related risks like droughts, floods, and storms. Parametric insurance policies tailored to specific crop cycles and regions are gaining traction, supported by government subsidies and international organizations aiming to enhance food security.

The renewable energy industry is also a burgeoning area, with parametric insurance providing innovative solutions to manage risks associated with insufficient wind, solar irradiation, or extreme weather conditions that can disrupt operations. As the global push for renewable energy accelerates, the demand for these specialized policies is expected to surge.

Recent Developments

In December 2024, Lockton has launched its Global Parametric Insurance Practice, aiming to provide efficient and customised parametric solutions to help clients address risks often overlooked by traditional insurance.

In November 2024, Rokstone, a global specialty insurance and reinsurance managing general agent (MGA) under the Aventum Group, has launched Rokstone Parametric in a strategic partnership with parametric insurance specialist NormanMax Lloyd’s Syndicate 3939.

In August 2024, AXA Hong Kong and Macau has launched the market-first “Heatwave Parametric Insurance”, an offering that aims to provide enhanced protection for outdoor practitioners that work outdoor in the summer.

Conclusion

The parametric insurance market is rapidly evolving, driven by the rising frequency of climate-related disasters, technological advancements, and increasing awareness of innovative risk management solutions. With its ability to provide swift payouts, transparency, and tailored coverage, parametric insurance is becoming a critical tool across industries such as agriculture, energy, real estate, and travel.

As governments and organizations prioritize resilience against unpredictable risks, and as technology continues to enhance efficiency and scalability, the market is poised for robust growth. Stakeholders who leverage these trends and address challenges like regulatory hurdles and consumer awareness will be well-positioned to capitalize on the immense opportunities in this transformative sector.

𝐄𝐱𝐭𝐞𝐧𝐬𝐢𝐯𝐞 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐢𝐧 𝐭𝐡𝐞 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲 𝐃𝐨𝐦𝐚𝐢𝐧:

Large Language Model (LLM) Market - https://market.us/report/large-language-model-llm-market/

Immersive Media Market - https://market.us/report/immersive-media-market/

AI in Enterprise Communications and Collaboration Market - https://market.us/report/ai-in-enterprise-communications-and-collaboration-market/

Edge Computing Market - https://market.us/report/edge-computing-market/

AI In Marketing Market - https://market.us/report/ai-in-marketing-market/

Smart City Market - https://market.us/report/smart-city-market/

Marketing Automation Market - https://market.us/report/marketing-automation-market/

Generative AI in Marketing Market - https://market.us/report/generative-ai-in-marketing-market/

Video Conferencing Market - https://market.us/report/video-conferencing-systems-market/

Debt Financing Market - https://market.us/report/debt-financing-market/

AI in Predictive Maintenance Market - https://market.us/report/ai-in-predictive-maintenance-market/

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release