Family Financial Credit Union Partners with Swaystack to Solve Digital Onboarding's Blind Spot: Account Activation

The credit union will address dormant memberships head-on, using targeted onboarding campaigns to immediately activate new, existing, and indirect members.

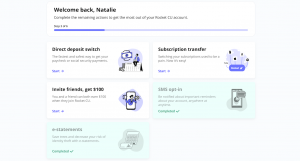

The onboarding experience is deployed directly inside Jack Henry Banno, letting FFCU meet members where they already bank. From the first login, new and existing members are guided to take key actions, like switching direct deposit or linking external accounts, giving FFCU the same first-impression firepower as megabanks and neobanks.

“Swaystack solves the problem we wrestle with every day,” said Deb Dietz, CEO of Family Financial Credit Union. “We need members to activate their checking accounts and stick around, not just open and disappear. From there, our goal is to turn indirect loans into full relationships, where direct deposit isn’t a maybe, it’s automatic. Most platforms stop at the welcome message. Swaystack keeps going. It nudges, guides, and pushes members to take the steps that actually matter. That’s what we’ve been missing.”

Unlike traditional onboarding tools, Swaystack replaces passivity with progress. Members aren't just welcomed, they're guided through a gamified experience that drives behaviors like account funding and deposit switching from the start. Each step is purposeful, building momentum, leading to stronger usage, better retention, and long-term value. Activation has long been the Achilles’ heel of digital account opening, but Swaystack is turning it into a strength.

“We first met Deb six years ago at Jack Henry Connect in San Diego,” said Har Rai Khalsa, Co-Founder and CEO of Swaystack. “She’s watched our journey ever since, and when we launched Swaystack, she got it instantly. This partnership didn’t start with a pitch; it started with shared experience and a deep understanding of what credit unions actually need.”

Khalsa added, “Activation is the gap most providers ignore. Our job isn’t to open accounts, it’s to move members to action. That’s how credit unions grow deposits, drive loyalty, and earn primary status.”

FFCU anticipates measurable outcomes: more funded accounts, higher direct deposit adoption, and stronger digital engagement. With Swaystack, the credit union gains a focused, repeatable approach to driving activation from the first login across its entire member base.

This partnership offers a replicable model for credit unions facing similar challenges. Rather than waiting for members to engage, FFCU meets them with intention, proving that onboarding doesn’t end with enrollment.

About Swaystack:

Swaystack, a personalized engagement platform, is spearheaded by second-time founders who share a passion for helping banks and credit unions compete with megabank and neobank technology. Har Rai Khalsa began his career as a lender in 2007, co-founded MK Decision in 2015 to help banks and credit unions compete with digital account opening, which was acquired by Alkami in 2021. Simran Singh Co-founded Zogo in 2018. As the CTO of Zogo, he helped 250+ financial institutions gamify financial education to over 1.1 million users. Simran and Har Rai have a collective 20+ years in fintech and have served over 300+ financial institutions with the companies they’ve built.

About Family Financial Credit Union

Family Financial Credit Union is a member-owned, not-for-profit financial institution serving the West Michigan community with a commitment to empowerment, pride, integrity, and community – values that drive its mission to help members “Be EPIC.” With a full suite of personal and business banking services, FFCU is dedicated to providing accessible, personalized financial solutions to help members achieve their goals. Headquartered in Muskegon, Michigan, FFCU proudly supports local initiatives and fosters financial well-being through education, innovation, and community engagement.

Har Rai Khalsa

Swaystack

email us here

Visit us on social media:

LinkedIn

YouTube

Swaystack's Gamified Onboarding via Jack Henry Banno

Distribution channels: Banking, Finance & Investment Industry, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release