Kohler Credit Union Partners with Swaystack to Transform Member Onboarding and Boost Digital Engagement

Inside digital banking, onboarding isn’t just about getting started. It’s about creating lasting momentum toward active, engaged relationships.

Based in Wisconsin and rooted in a strong member-first philosophy, Kohler Credit Union identified a clear breakdown: members were joining, but the relationship wasn’t moving forward. Direct deposits stayed elsewhere. The mobile app went unused. E-statements saw low adoption. The intent was there, but follow-through lagged. Without clear direction, members were left to figure it out alone, and many didn’t.

“We had the right products, but we lacked a cohesive onboarding experience that actively engaged members,” said Matthew Fehrmann, CIO of Kohler Credit Union. “People need direction more than additional features. Swaystack’s personalized, omnichannel approach bridges the gap, starting the member journey before they even log into digital banking.”

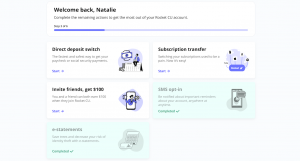

The onboarding process begins with personalized emails containing unique URLs, prompting members to complete initial, high-impact actions such as enrolling in online banking, downloading the mobile app, opting into e-statements, and setting up direct deposits. Upon logging into Kohler Credit Union’s Q2 digital banking experience, members who haven't yet completed these tasks receive continued, personalized prompts to ensure full engagement:

• Establishing direct deposit boosts member balances and positions Kohler Credit Union as the primary financial institution, with industry data indicating members can average up to 23% higher balances when direct deposit is established (Financial Brand, 2024).

• Adopting e-statements significantly reduces operational costs and provides quicker, more secure access to financial records.

• Activating debit cards and transferring subscriptions help members fully utilize their accounts, improving ongoing engagement.

Each interaction is designed strategically, ensuring members actively use their accounts from the outset. Swaystack extends this proactive approach into lending, guiding borrowers through critical actions such as loan payment setup, product cross-selling, and mobile app adoption.

At a time when 29% of Kohler Credit Union members weren’t using digital banking, and when many indirect auto loan borrowers were never fully onboarded, this shift is more than a UX update; it’s a business strategy. Swaystack’s platform prompts action, analyzes behavior, and adapts over time.

“You can’t ask someone to commit to your institution if you never show them how,” said Har Rai Khalsa, Co-founder and CEO of Swaystack. “We don’t drop members into digital banking and hope they figure it out. We guide them, nudge them, reward them, and connect the dots between behavior and benefit.”

This partnership offers a practical path forward for credit unions navigating rising acquisition costs and changing member expectations. Megabanks may offer perks, and fintechs may provide speed. But trust, without a plan to back it up, won’t keep members engaged.

That’s why Kohler Credit Union sought an innovative partner who could move fast, integrate deeply with Q2, and bring new thinking to old pain points. But it wasn’t just the technology; it was the collaboration.

“Kohler Credit Union didn’t ask for a vendor. They asked for a partner,” added Khalsa. “We meet weekly, we test, we learn, we adjust. This isn’t software you install and walk away from—it’s a partnership built to evolve.”

For Fehrmann, outcomes like increased direct deposit and higher engagement are important, but success starts even earlier. “If a member logs in for the first time and thinks, ‘They actually thought this through,’ that’s the win. That’s how trust is built.”

About Swaystack

Swaystack, a personalized engagement platform, is spearheaded by second-time founders who share a passion for helping banks and credit unions compete with megabank and neobank technology. Har Rai Khalsa began his career as a lender in 2007, co-founded MK Decision in 2015 to help banks and credit unions compete with digital account opening, which was acquired by Alkami in 2021. Simran Singh Co-founded Zogo in 2018. As the CTO of Zogo, he helped 250+ financial institutions gamify financial education to over 1.1 million users. Simran and Har Rai have a collective 20+ years in fintech and have served over 300+ financial institutions with the companies they’ve built.

About Kohler Credit Union

For almost 100 years, Kohler Credit Union (KCU) has committed to enriching communities through building lasting relationships with our members, so they can achieve their financial dreams.

As a $740 million not-for-profit financial cooperative, we are owned and governed by our members. Membership is open to anyone who lives or works in Sheboygan, Calumet, Fond du Lac, Manitowoc, Milwaukee, Ozaukee, Washington, Door, Kewaunee, Brown, or Waukesha county, as well as their immediate family members and associated organizations.

Kohler Credit Union - Here For Life

Har Rai Khalsa

Swaystack

email us here

Visit us on social media:

LinkedIn

YouTube

Intro to Swaystack

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, IT Industry, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release